Fri October 11, 2024 ▪

5

min reading ▪ acc

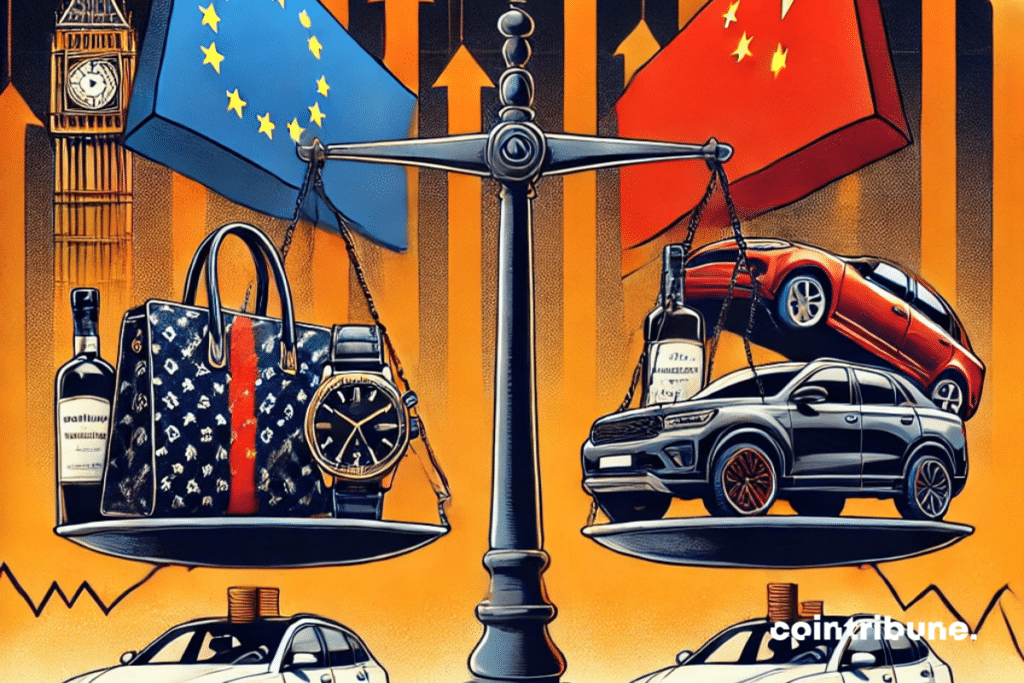

The trade war between the European Union and China is taking an unexpected turn. While the first sanctions fall on such strategic sectors as electric vehicles or spirits, a new player enters the chaos: European luxury. This economic bastion, which symbolizes the creativity and prosperity of Europe, is now at the heart of speculation about possible Chinese retaliation. But behind this apparent storm, a more delicate balance emerges. Experts, aware of the colossal economic challenges facing China itself, are asking: will Beijing really run the risk of slowing down one of the drivers of its domestic consumption? In this article, we will first discuss the immediate consequences of this crisis on European luxury financial markets. We then delve into the long-term outlook and scenarios that could shape the relationship between these two economic giants.

Luxury values weakened by business uncertainty

Last Tuesday, the European luxury sector suffered a significant setback on the stock market, marked by the fall of the biggest houses such as LVMH (-3.57%) and Kering (-4.45%). The panic among investors follows the announcement of new protectionist measures by China targeting European spirits.

Amid rising trade tensions between Brussels and Beijing, concerns that luxury goods would become the next target of China’s retaliation had an immediate impact on share prices, leading to significant market volatility. Big brands, emblems of European economic power, find themselves at the center of speculation as the conflict spreads to various strategic sectors.

The market reaction comes after a series of measures taken by the European Union against Chinese electric vehicles accused of illegal subsidies. Beijing reacted quickly in response by targeting European spirits imports, dampening investor forecasts. Analysts now fear an escalation that could affect the luxury sector, which is essential to China’s domestic growth. An attack on this segment would mean not only the destabilization of the European economy, but also damage to the strategic interests of China itself.

A luxury, strategic sector that China could spare

Despite investor concerns, many experts believe that a focus on the luxury sector would run counter to Beijing’s economic interests. Jacques Roizen of the Digital Luxury Group points out that China has everything to gain from maintaining a favorable environment for luxury brands, which represent an important source of tax revenue and contribute to the development of domestic consumption.

Hainan province, for example, has become a hub for duty-free sales of luxury goods, evidence that Chinese authorities are trying to keep consumer spending at home. Imposing protectionist measures on the industry would encourage Chinese consumers to shop abroad, something Beijing tries to avoid at all costs.

Moreover, the size and importance of China’s luxury industry makes it less vulnerable to allegations of dumping, unlike electric vehicles, where state subsidies are more easily proven. As Jelena Sokolová, an analyst at Morningstar, points out, it is difficult to justify dumping practices for such exclusive goods as luxury handbags or watches, the prices of which are largely determined by brand image and product scarcity. Moreover, recent statements from Beijing and Brussels show the desire of both sides to maintain a dialogue and indicate the possibility of a compromise to avoid an escalation that would harm their common economic interests.

If European luxury remains spared China’s protectionist measures for the time being, the sector will remain under pressure due to market volatility and geopolitical tensions. But analysts caution that Beijing has little interest in engaging in an economic battle in the area, given the importance of luxury brands to the Chinese economy. The ongoing negotiations between the European Union and China will be decisive for the future of the conflict, but for now it seems that luxury could continue to develop on the sidelines of commercial retaliation.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

A graduate of Sciences Po Toulouse and holder of the blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I made a commitment to raise awareness and inform the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and take advantage of the opportunities it offers. Every day I try to provide an objective analysis of current events, decipher market trends, convey the latest technological innovations and put into perspective the economic and social problems of this ongoing revolution.

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.